Progressive Car Insurance Reviews

Progressive has emerged as a top contender in the insurance market, earning an impressive 9.0 out of 10.0 rating and securing the prestigious Best for High-Tech Drivers award. The company’s appeal lies in its ability to offer affordable prices coupled with flexible options tailored to specific driver profiles.

About Progressive Insurance Company

Progressive stands as the second-largest auto insurer in the United States, boasting a significant 14.05% market share as of 2022. With a robust selection of standard car insurance coverage and a range of add-on options, Progressive caters to diverse customer needs.

Progressive Auto Insurance Coverage

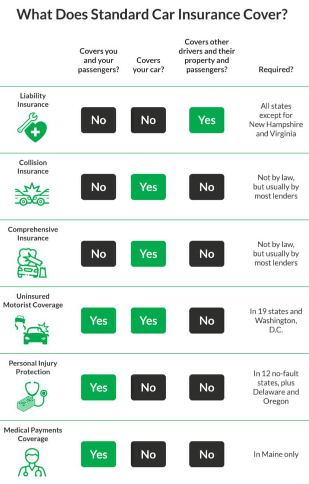

From basic liability coverage to comprehensive protection, Progressive offers a spectrum of auto insurance options to address various driver requirements and preferences.

How Much Is Progressive Car Insurance?

Understanding the cost of Progressive car insurance is crucial for informed decision-making. On average, full-coverage policies with Progressive amount to $2,030 annually, while minimum coverage stands at approximately $697 per year for good drivers.

Progressive Homeowners Insurance

In addition to its auto insurance offerings, Progressive extends its services to homeowners insurance, providing comprehensive coverage at rates often below the national average.

Progressive Home Insurance Coverage

Progressive’s homeowners insurance policies encompass a wide array of coverage options, safeguarding homes and personal belongings against various perils.

Progressive Life Insurance

While Progressive primarily focuses on auto and homeowners insurance, it also offers life insurance products to meet customers’ long-term financial planning needs.

Progressive Auto Insurance Reviews: The Bottom Line

Progressive’s track record and customer feedback position it as one of the premier choices for auto insurance in 2024. Its commitment to affordability, innovation, and customer satisfaction sets it apart in the competitive insurance landscape.

Related searches

Progressive Car Insurance: FAQ

Is Progressive Insurance Good?

Progressive, with its A+ Better Business Bureau rating and strong financial standing, offers compelling insurance solutions. However, customer reviews vary, emphasizing the importance of personalized evaluation.

Pros and Cons of Progressive Auto Insurance

Progressive’s strengths lie in its financial stability, extensive coverage options, and innovative programs like the Snapshot program. However, challenges exist, including average customer service ratings and potential rate increases under certain circumstances.

How Does Progressive Handle Claims?

Progressive streamlines the claims process through various channels, ensuring prompt assistance and efficient resolution for policyholders.

Our Methodology

At Online Live Insurance Guides, our review process involves meticulous research and analysis, focusing on key metrics such as reputation, availability, coverage, cost, and customer experience to provide unbiased evaluations.

Progressive Insurance: Conclusion

In conclusion, Progressive Insurance stands as a formidable player in the insurance industry, offering competitive rates, innovative solutions, and comprehensive coverage options. As customer needs evolve, Progressive remains committed to delivering tailored insurance solutions that prioritize affordability and flexibility.