- 1 Introduction

- 2 Auto Insurance in 0651

- 3 Importance of Auto Insurance

- 4 Types of Auto Insurance Coverage

- 5 Determining Your Coverage Needs

- 6 Factors Affecting Auto Insurance Rates

- 7 Frequently Asked Questions about Auto Insurance in 06519

- 8 Top 5 Insurance Companies in 06519

- 9 Conclusion

- 10 RELATED ARTICLES

Introduction

Auto insurance is a crucial aspect of responsible vehicle ownership, providing financial protection in case of accidents, theft, or other damages. In the 06519 area, adequate coverage is a legal requirement and an intelligent decision to safeguard assets and ensure peace of mind on the road. This article will explore the ins and outs of auto insurance in 06519, covering coverage options, cost factors, and frequently asked questions.

Auto Insurance in 0651

What is Auto Insurance?

Auto insurance serves as a crucial contract between you and an insurance company, offering financial protection in the event of accidents or damages related to your vehicle. It entails regular premium payments in exchange for coverage of repairs, medical expenses, and liability claims.

Importance of Auto Insurance

Auto insurance is indispensable for safeguarding yourself, your vehicle, and others on the road. Accidents occur unexpectedly, and the resulting financial burdens can be overwhelming. Auto insurance mitigates these risks by providing coverage and ensuring you aren’t solely responsible for substantial expenses.

Types of Auto Insurance Coverage

In 06519, various coverage options are available, including:

- Liability Coverage: Pays for damages and injuries caused to others in an accident.

- Collision Coverage: Covers repair or replacement costs in case of a collision.

- Comprehensive Coverage: Protects against non-collision damages like theft or vandalism.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you’re in an accident with an uninsured or underinsured driver.

Determining Your Coverage Needs

Your auto insurance needs depend on factors such as state requirements, vehicle value, personal assets, and risk tolerance. It’s advisable to have liability coverage meeting or exceeding state standards and considering comprehensive and collision coverage based on your vehicle’s value andfinancial situation.

Factors Affecting Auto Insurance Rates

Several elements influence auto insurance costs in the 06519 area:

- Driving Record: A clean record generally results in lower premiums.

- Vehicle Type: Factors like make, model, age, and safety features impact rates.

- Coverage Limits and Deductibles: Balancing coverage and deductible levels affects premiums.

- Location: Areas with higher accident rates or thefts often have higher premiums.

- Credit History: Maintaining a good credit score can lead to better rates.

Frequently Asked Questions about Auto Insurance in 06519

Q1: What are the legal requirements for auto insurance in 06519?

Connecticut mandates minimum liability coverage of $25,000 for bodily injury per person, $50,000 per accident, and $25,000 for property damage.

Q2: Can I purchase additional coverage options along with required liability coverage?

Yes, it’s recommended to consider additional options such as collision and comprehensive coverage for enhanced protection.

Q3: Are there discounts available to reduce auto insurance premiums?

Many insurers offer discounts like safe driver discounts and multi-policy discounts. Inquire with your provider about available options.

Top 5 Insurance Companies in 06519

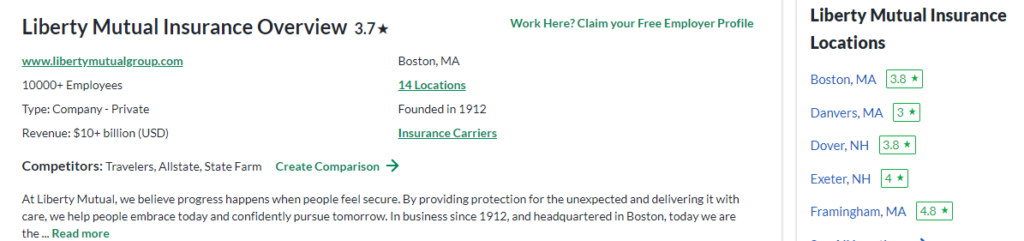

Liberty Mutual Insurance

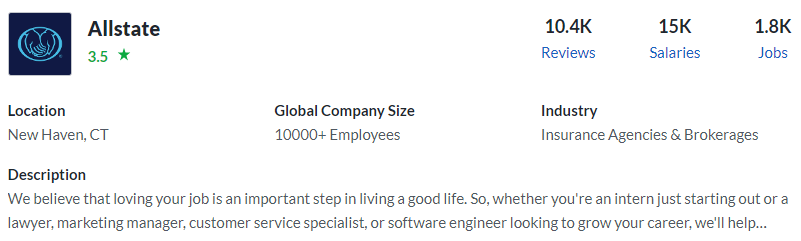

Allstate

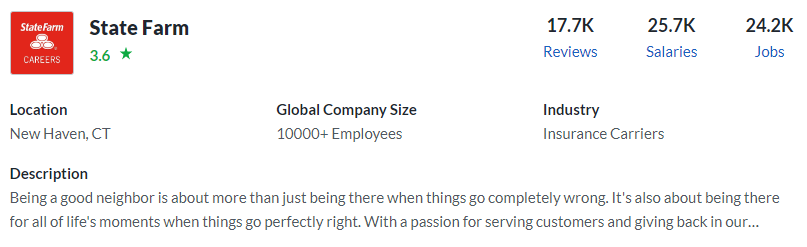

State Farm

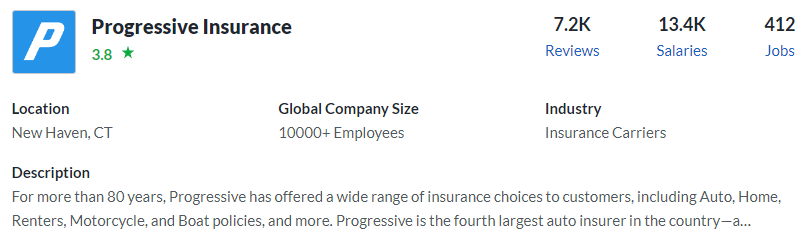

Progressive Insurance

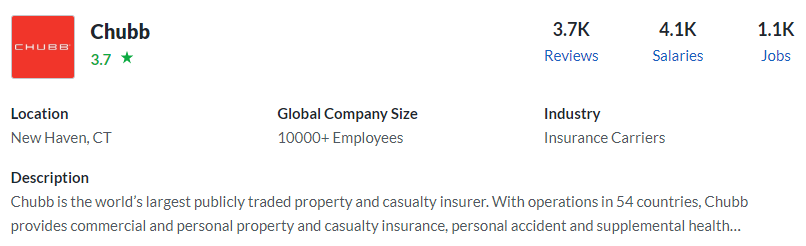

Chubb

Conclusion

Auto insurance in 06519 is vital for responsible vehicle ownership. By understanding the basics, considering influencing factors, and exploring coverage options, you can make informed decisions to protect yourself and your vehicle. Remember to compare quotes, review policy terms, and prioritize safety on the road.

RELATED ARTICLES

Top 10 Life Insurance Companies in India

Disclaimer: The information provided in this blog is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the information, products, services, or related graphics contained in this blog for any purpose. Any reliance you place on such information is therefore strictly at your own risk.