Are you considering MetLife life insurance for your needs? In this detailed review, we explore the pros and cons of MetLife, its history, financial ratings, and the various life insurance products it offers. Whether you’re interested in term plans, saving plans, or pension plans, we’ve got you covered. Read on to make an informed decision about your life insurance.

- 1 What’s New in 2024 For Metlife Insurance

- 2 MetLife Life Insurance Company History

- 3 MetLife Life Insurance Ratings – Financial

- 4 MetLife Life Insurance Company Products

- 5 MetLife Life Underwriting Comparison

- 6 How Does MetLife Life Insurance Quote

- 7 Bottom Line Of Metlife Life Insurance Company

- 8 Metlife Life Insurance Company Customers Reviews

- 9 Related searches For Metlife Life Insurance

- 10 People also ask life insurance Metlife

- 11 Check More Blogs here:

What’s New in 2024 For Metlife Insurance

New Products or Changes

The COVID-19 pandemic prompted MetLife to reevaluate its approach, leading to policy changes that adapt to the post-COVID market. The company stress-tests its infrastructure, ensuring it meets customer expectations by providing alternative solutions for potential system disruptions.

MetLife Insurance on the News

MetLife’s stock prices fluctuated due to the pandemic, but the company, like its counterparts, recovered steadily since 2024. Positive customer reviews highlight MetLife’s service quality and identity theft protection, earning it a 3.5 out of 5-star rating from Nerdwallet.

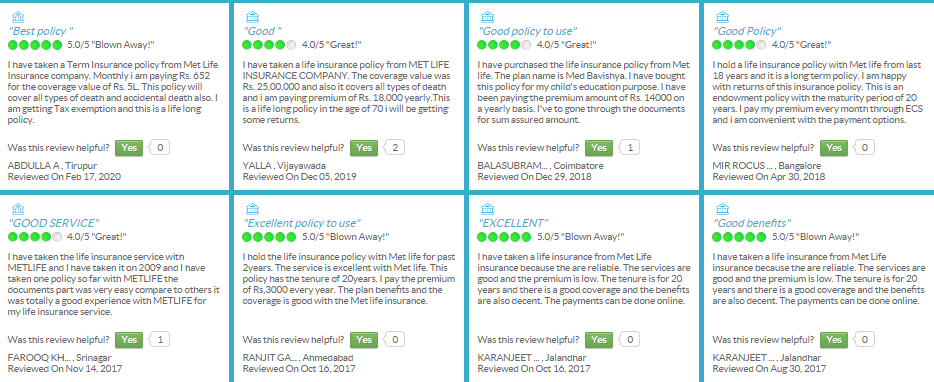

Latest Company Reviews

Customer reviews vary, with positive feedback on swift claims processing. Some concerns include billing inconsistencies and delayed 401k contributions. Notably, home insurance reviews outshine auto insurance reviews.

Ratings and Honors

MetLife’s financial stability is reflected in its ratings from S&P Global (AA-), Moody’s (Aa3), and AM Best (A+). The company, in business since 1868, serves all 50 states and is recognized for its MetLife Advantages workplace benefits suite.

MetLife Life Insurance Company History

Established during the Civil War in 1863, MetLife (originally National Union Life) initially focused on wartime disabilities. By 1868, it transitioned to life insurance, becoming Metropolitan Life Insurance Company. MetLife overcame challenges, expanded globally, and is now a leading insurer with over 90 million customers.

MetLife Life Insurance Ratings – Financial

MetLife boasts financial stability, evident in ratings from major agencies. The company consistently receives high marks, ensuring policyholders can trust its ability to honor obligations. These ratings underscore MetLife’s position as a reliable life insurance provider.

MetLife Life Insurance Company Products

Life Insurance Metlife offers a range of life insurance products catering to diverse needs:

MetLife Term Life Insurance Review

MetLife’s term life insurance provides affordable coverage with options for 10, 15, 20, and 30-year terms. Policies over $100,000 offer fixed-term insurance, maintaining consistent premiums and coverage throughout the term.

MetLife Whole Life Insurance Review

Whole life insurance from MetLife covers you for your entire life, offering death benefits and a cash value accumulation feature. Though more expensive, it provides financial security and non-taxable benefits.

MetLife Universal Life Insurance

Universal life insurance adds flexibility, allowing policyholders to manage premiums and death benefits. MetLife offers various universal policy types, providing control over cash value investments.

MetLife Life Underwriting Comparison

MetLife’s underwriting guidelines cater to specific niches, making it suitable for individuals with conditions like Type 1 Diabetes, Type 2 Diabetes, and active-duty military service personnel. The company’s lenient underwriting makes it competitive in the market.

Financial Strength and Recognition

MetLife boasts a long and reputable history as a financially sound insurance company, garnering top ratings from multiple independent agencies. These agencies have consistently awarded MetLife their highest ratings, signifying stability with no foreseeable downgrades. Notably, MetLife has received accolades such as being named one of Fortune Magazine’s “World’s Most Admired Companies” and earning a place in Bloomberg’s Gender-Equality Index for five consecutive years.

How Does MetLife Life Insurance Quote

MetLife’s affordability is evident in competitive premium rates. A Preferred Non-Tobacco policy for $250,000 coverage over a 20-year term ranks MetLife among the top 5-10 lowest premium providers.

Bottom Line Of Metlife Life Insurance Company

In summary, MetLife stands out for its:

- Excellent range of life insurance products

- Competitive rates for various health conditions

- Financial stability, ensuring policyholder confidence

Metlife Life Insurance Company Customers Reviews

Related searches For Metlife Life Insurance

| Metlife life insurance login payment | metlife life insurance phone number | Metlife life insurance login issues | metlife phone number |

| Metlife life insurance login claims | metlife customer service | metlife employer login | Metlife Life Insurance Login |

| can i view my metlife policy online? | brighthouse metlife login | metlife life insurance customer service | metlife term life insurance |

People also ask life insurance Metlife

- How do I access my MetLife account?

- How do I check my MetLife policy details?

- How do I check my MetLife claim status?

- Can I withdraw money from my MetLife life insurance policy?

- What is a MetLife Total Control Account (TCA)?

MetLife TCA is a settlement option for claim payments, not a bank account. It is not insured by the FDIC or government agencies but MetLife guarantees the full amount, including interest earned. The relationship is between the beneficiary and MetLife, not with the federal government or its agencies. The MetLife TCA offers a minimum guaranteed annual effective interest rate, with daily interest earned but not credited until the last day of the month. The beneficiary has complete control of the insurance proceeds, can withdraw the full amount at any time, receives draft books, periodic activity statements, and can designate a beneficiary. - Is MetLife a good life insurance company?

- What types of life insurance does MetLife offer?

- What is the average life insurance cost per month with MetLife?

- Does MetLife pay out dividends to its policyholders?

- Does MetLife life insurance require a medical exam?

- Can you cancel MetLife life insurance?

Disclaimer: The information provided in this blog on MetLife Life Insurance is for general informational purposes only. It is not intended as professional advice and should not be considered a substitute for consulting with a qualified insurance professional. Readers are encouraged to independently research and verify information before making any decisions regarding life insurance products or policies. The author and the blog publisher are not liable for any errors, omissions, or inaccuracies in the content and disclaim any responsibility for actions taken based on the information provided.