- 1 Introduction

- 2 Unveiling Max Life Insurance Login Benefits

- 3 Navigating Customer Care for Maximized Support

- 4 Smooth Sailing with Max Life Insurance Payments

- 5 Unlocking the Benefits of Max Life Term Insurance

- 6 Understanding the Various Types of Life Insurance

- 7 FAQs Unveiled – Demystifying Max Life Insurance

- 8 People also ask

- 9 Read More Blogs

Introduction

Welcome to a detailed exploration of Max Life Insurance, your key to financial security. In this article, we delve into the intricacies of max life insurance login, customer care, payments, term insurance, and address FAQs to equip you with the knowledge needed for sound decisions.

Max Life Insurance – Ensuring Your Financial Future

Unveiling Max Life Insurance Login Benefits

Embark on a seamless journey with Max Life Insurance login. Effortlessly access policy details, premium payments, and essential updates. Simplifying your insurance experience, login ensures a user-friendly interface and convenient navigation.

Max Life Insurance prioritizes customer satisfaction. Explore the dedicated customer care services, addressing queries, resolving concerns, and providing expert guidance. Discover the assurance of responsive and reliable support for a worry-free experience.

Smooth Sailing with Max Life Insurance Payments

Experience hassle-free transactions with Max Life Insurance payments. This section guides you through secure payment processes, modes of payment, and timely reminders. Maximize convenience while ensuring your policy remains active.

Unlocking the Benefits of Max Life Term Insurance

Dive into the realm of protection with Max Life Term Insurance. Understand the significance, coverage details, and customization options. Secure your loved ones’ future with a comprehensive term insurance plan tailored to your specific needs.

Understanding the Various Types of Life Insurance

Life insurance comes in various forms, each catering to different financial needs and goals. Here’s a breakdown of the types of life insurance available:

Term Insurance:

Term insurance is the most straightforward form of life coverage. It offers financial protection to the insured’s family in the event of untimely death. Depending on income and liabilities, individuals can choose an appropriate sum assured to safeguard the financial interests of their loved ones.

ULIP (Unit Linked Insurance Plan):

A Unit Linked Insurance Plan (ULIP) is a unique life insurance variant that combines life cover with investment opportunities in market-linked instruments. By investing in ULIPs, individuals benefit from market-linked returns over the long term, life coverage, income tax savings, and the flexibility to switch between funds. Life insurance quotes can assist in determining the required amount for financial security and efficient investment allocation.

Retirement Plans:

Designed to provide financial security during retirement, these life insurance products help individuals invest money throughout their working years, creating a corpus for retirement. Investing in retirement plans is a disciplined approach to planning for the golden years of life.

Child Plans:

Child insurance plans, also known as saving life insurance plans, focus on securing a child’s future. Alongside life cover, these plans offer pay-outs at various educational milestones. Investing in child plans safeguards against unforeseen events like death or critical illnesses, ensuring a stable future for the child.

Savings and Income Plans:

Life insurance products like savings and income plans encourage disciplined savings, providing steady returns in the form of monthly income or a lump sum. These plans offer additional benefits such as death benefits, tax benefits, and terminal illness benefits. It’s essential to check life insurance quotes and details before making investment decisions.

Group Insurance Plans:

Tailored for organizations or groups, these plans offer life cover to employees or group members, respectively. Employers utilize group insurance plans to ensure the financial security of their employees’ families, fostering a motivated workforce. Individuals can also explore life insurance quotes for additional financial security for their loved ones.

Understanding the nuances of each life insurance type empowers individuals to make informed decisions based on their unique financial circumstances and goals.

FAQs Unveiled – Demystifying Max Life Insurance

Is Max Life Insurance Safe?

Rest assured, Max Life Insurance prioritizes the safety of your investments. Rigorous security measures and regulatory compliance ensure your financial future is in trusted hands.

What is Max Life Insurance?

Max Life Insurance is your partner in securing your family’s future. Offering a range of policies, it caters to diverse needs, ensuring financial stability and peace of mind.

How to Withdraw Max Life Insurance Policy?

Navigate the policy withdrawal process effortlessly. Log in, access your policy details, follow the withdrawal procedure outlined in your account, and enjoy the flexibility to meet evolving financial goals.

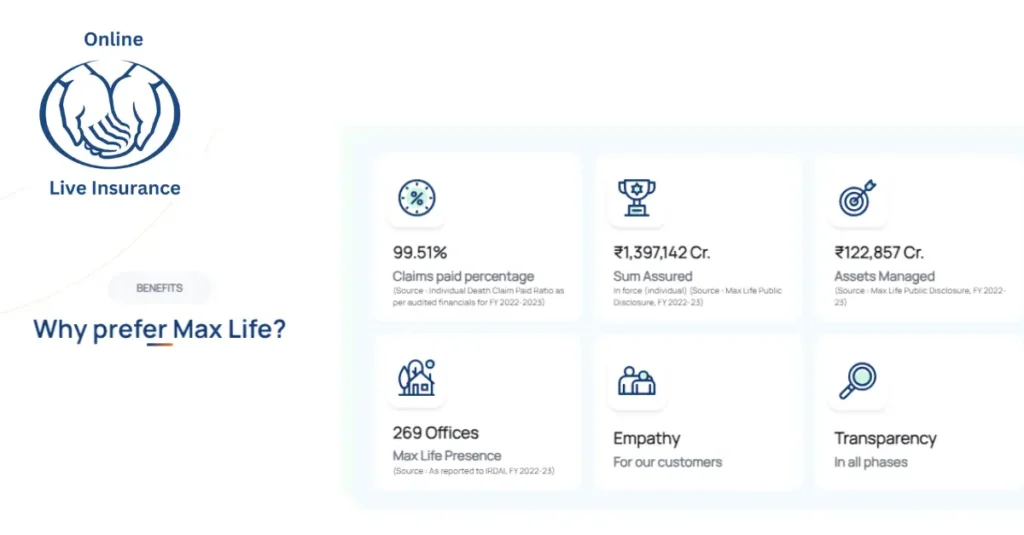

Why Prefer Max Life Insurance?

People also ask

- Does life insurance give you peace of mind?

- How does insurance give peace of mind?

- Is it good to invest in Max Life Insurance?

- बीमा मन की शांति कैसे देता है?

Conclusion

In conclusion, Max Life Insurance emerges as a stalwart guardian of your financial well-being. From the ease of login to responsive customer care, seamless payments, and comprehensive term insurance, Max Life Insurance stands as a beacon of reliability. Have more questions? Explore the FAQs or reach out to our dedicated customer support. Make informed decisions and embrace a secure future with Max Life Insurance.